2025 Nanoparticle Analyzation Technologies Market Report: Trends, Forecasts, and Strategic Insights for the Next 5 Years. Explore Key Growth Drivers, Regional Dynamics, and Competitive Strategies Shaping the Industry.

- Executive Summary & Market Overview

- Key Technology Trends in Nanoparticle Analyzation

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Challenges and Opportunities in Nanoparticle Analyzation Technologies

- Future Outlook: Innovation, Regulation, and Market Expansion

- Sources & References

Executive Summary & Market Overview

Nanoparticle analyzation technologies encompass a suite of advanced tools and methodologies designed to characterize, measure, and monitor nanoparticles—particles with dimensions between 1 and 100 nanometers. These technologies are critical for industries such as pharmaceuticals, electronics, energy, and environmental science, where precise nanoparticle characterization underpins product quality, regulatory compliance, and innovation. The global market for nanoparticle analyzation technologies is experiencing robust growth, driven by increasing nanotechnology adoption, stringent regulatory standards, and expanding applications in drug delivery, diagnostics, and materials science.

According to MarketsandMarkets, the global nanoparticle analysis market was valued at approximately USD 3.5 billion in 2023 and is projected to reach USD 5.2 billion by 2028, growing at a CAGR of around 8.2%. This growth is fueled by rising R&D investments, particularly in the pharmaceutical and biotechnology sectors, where nanoparticle-based formulations and therapies are gaining traction. Additionally, the electronics industry’s demand for advanced materials with nanoscale features is propelling the need for precise analyzation tools.

Key technologies in this market include dynamic light scattering (DLS), nanoparticle tracking analysis (NTA), electron microscopy (EM), atomic force microscopy (AFM), and X-ray diffraction (XRD). Each technology offers unique advantages in terms of sensitivity, throughput, and the types of information provided, such as particle size distribution, morphology, surface charge, and chemical composition. The integration of artificial intelligence and automation is further enhancing the accuracy and efficiency of nanoparticle characterization workflows.

Geographically, North America and Europe dominate the market, supported by strong research infrastructure, significant funding, and a high concentration of nanotechnology companies. However, the Asia-Pacific region is expected to witness the fastest growth, driven by expanding manufacturing capabilities and increasing government initiatives to promote nanotechnology research, particularly in China, Japan, and South Korea (Grand View Research).

- Pharmaceuticals: Demand for nanoparticle analyzation is surging due to the rise of nanomedicine and targeted drug delivery systems.

- Electronics: Miniaturization trends are increasing the need for nanoscale material characterization.

- Environmental Monitoring: Regulatory agencies are mandating nanoparticle detection in air, water, and soil.

In summary, the nanoparticle analyzation technologies market in 2025 is characterized by rapid innovation, expanding end-use applications, and a competitive landscape shaped by both established instrument manufacturers and emerging technology providers (Thermo Fisher Scientific).

Key Technology Trends in Nanoparticle Analyzation

Nanoparticle analyzation technologies are rapidly evolving, driven by the increasing demand for precise characterization in sectors such as pharmaceuticals, electronics, and advanced materials. As of 2025, several key technology trends are shaping the landscape of nanoparticle analysis, focusing on improved sensitivity, automation, and integration with data analytics.

- Advanced Imaging and Spectroscopy: High-resolution electron microscopy, such as transmission electron microscopy (TEM) and scanning electron microscopy (SEM), remains foundational for direct visualization of nanoparticles. Recent advancements include the integration of cryo-TEM and automated image analysis, enabling more accurate size and morphology assessments. Additionally, enhanced spectroscopic techniques like Raman and Fourier-transform infrared (FTIR) spectroscopy are being combined with imaging to provide both structural and chemical information at the nanoscale (Thermo Fisher Scientific).

- Dynamic Light Scattering (DLS) and Nanoparticle Tracking Analysis (NTA): DLS continues to be a mainstay for rapid particle size distribution measurements, but 2025 sees a surge in the adoption of NTA, which offers single-particle tracking and concentration analysis. Innovations in laser optics and camera sensitivity are improving the accuracy and lower detection limits of these methods (Malvern Panalytical).

- Automated and High-Throughput Platforms: Automation is a significant trend, with new platforms enabling high-throughput screening of nanoparticle samples. Robotic sample handling, integrated data processing, and cloud-based result sharing are reducing human error and accelerating research timelines (Bruker Corporation).

- Integration with Artificial Intelligence (AI): AI-driven data analysis is being increasingly integrated into nanoparticle analyzation workflows. Machine learning algorithms are used to interpret complex datasets, identify patterns, and predict nanoparticle behavior, enhancing both speed and reliability of results (IBM).

- Portable and In-Situ Analyzers: The development of compact, field-deployable analyzers is enabling real-time nanoparticle monitoring in environmental and industrial settings. These portable devices leverage miniaturized sensors and wireless connectivity for on-site analysis, supporting regulatory compliance and process control (HORIBA).

Collectively, these trends are making nanoparticle analyzation more accessible, accurate, and adaptable to diverse application needs, positioning the technology for continued growth and innovation in 2025 and beyond.

Competitive Landscape and Leading Players

The competitive landscape for nanoparticle analyzation technologies in 2025 is characterized by a mix of established analytical instrumentation giants and innovative niche players, all vying to address the growing demand for precise nanoparticle characterization across industries such as pharmaceuticals, electronics, and advanced materials. The market is driven by the need for high-resolution, rapid, and multi-parameter analysis of nanoparticles, with a focus on size distribution, morphology, surface charge, and chemical composition.

Key players dominating this sector include Malvern Panalytical, Beckman Coulter, HORIBA Scientific, and Brookhaven Instruments. These companies offer a range of technologies such as dynamic light scattering (DLS), nanoparticle tracking analysis (NTA), electron microscopy, and tunable resistive pulse sensing (TRPS). Malvern Panalytical leads with its Zetasizer series, which integrates DLS and electrophoretic light scattering for comprehensive particle size and zeta potential analysis. Beckman Coulter is recognized for its advanced flow cytometry and analytical ultracentrifugation platforms, catering to both research and industrial applications.

Emerging players and startups are also making significant inroads, particularly in the development of portable, user-friendly, and high-throughput analyzers. Companies such as Particle Metrix and NanoSight (part of Malvern Panalytical) are notable for their innovations in NTA, enabling real-time visualization and quantification of nanoparticles in complex matrices. Additionally, HORIBA Scientific continues to expand its portfolio with Raman spectroscopy and nanoparticle tracking solutions, targeting both academic and industrial laboratories.

- Strategic collaborations and acquisitions are shaping the competitive dynamics, with leading firms acquiring niche technology providers to broaden their analytical capabilities and global reach.

- There is a trend toward integration of artificial intelligence and machine learning for automated data interpretation, as seen in recent product launches by Malvern Panalytical and Beckman Coulter.

- Geographically, North America and Europe remain the largest markets, but significant growth is anticipated in Asia-Pacific, driven by expanding nanotechnology research and manufacturing sectors.

Overall, the competitive landscape in 2025 is marked by technological innovation, strategic partnerships, and a focus on user-centric solutions, as companies strive to meet the evolving needs of nanoparticle research and quality control.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The global market for nanoparticle analyzation technologies is poised for robust growth between 2025 and 2030, driven by expanding applications in pharmaceuticals, materials science, and environmental monitoring. According to projections by MarketsandMarkets, the nanoparticle analysis market is expected to register a compound annual growth rate (CAGR) of approximately 6.8% during this period. This growth is underpinned by increasing R&D investments, stringent regulatory requirements for nanoparticle characterization, and the rising adoption of nanotechnology in drug development and quality control.

Revenue forecasts indicate that the global market, valued at around USD 4.2 billion in 2025, could reach nearly USD 5.9 billion by 2030. This upward trajectory is attributed to the proliferation of advanced analyzation platforms such as nanoparticle tracking analysis (NTA), dynamic light scattering (DLS), and electron microscopy, which are becoming standard tools in both academic and industrial laboratories. The pharmaceutical sector, in particular, is anticipated to account for the largest share of market revenue, as regulatory agencies like the U.S. Food and Drug Administration and European Medicines Agency increasingly mandate detailed nanoparticle characterization for novel drug formulations.

In terms of volume, the number of nanoparticle analyzation instruments shipped globally is projected to grow at a CAGR of 7.1% from 2025 to 2030, according to Grand View Research. This volume growth is fueled by the expansion of nanotechnology research hubs in Asia-Pacific, particularly in China, Japan, and South Korea, where government funding and private investment are accelerating the adoption of cutting-edge analytical technologies. Additionally, the emergence of portable and user-friendly analyzation devices is expected to broaden market access, especially among small and mid-sized enterprises.

- Key growth drivers: Pharmaceutical innovation, regulatory compliance, and technological advancements in analyzation platforms.

- Regional outlook: North America and Europe will maintain market leadership, but Asia-Pacific is forecasted to exhibit the fastest CAGR due to increased R&D spending and manufacturing activity.

- Segment trends: Dynamic light scattering and nanoparticle tracking analysis will remain dominant, while demand for high-resolution electron microscopy is set to rise in advanced research applications.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global market for nanoparticle analyzation technologies is experiencing robust growth, with regional dynamics shaped by varying levels of research investment, industrial adoption, and regulatory frameworks. In 2025, North America, Europe, Asia-Pacific, and the Rest of the World (RoW) each present distinct opportunities and challenges for market participants.

North America remains the largest market, driven by significant R&D spending, a strong presence of pharmaceutical and biotechnology companies, and advanced academic research infrastructure. The United States, in particular, benefits from substantial funding from agencies such as the National Institutes of Health and the National Science Foundation, fostering innovation in nanoparticle characterization. The region’s regulatory clarity and early adoption of advanced analytical instruments further support market growth. Key players such as Thermo Fisher Scientific and Agilent Technologies are headquartered here, contributing to technological advancements and market leadership.

Europe is the second-largest market, characterized by strong government support for nanotechnology research and a collaborative ecosystem involving universities, research institutes, and industry. The European Commission funds numerous projects under its Horizon Europe program, promoting the development and adoption of nanoparticle analyzation tools. Countries such as Germany, the UK, and France are at the forefront, with a focus on applications in healthcare, materials science, and environmental monitoring. Stringent regulatory standards in the European Union also drive demand for precise and reliable analyzation technologies.

- Asia-Pacific is the fastest-growing region, propelled by expanding pharmaceutical manufacturing, increasing investment in nanotechnology, and rising academic research output. China, Japan, and South Korea are leading the charge, with government initiatives such as China’s Ministry of Science and Technology supporting large-scale nanoscience projects. The region’s cost-competitive manufacturing and growing domestic demand for advanced materials and drug delivery systems are accelerating adoption of nanoparticle analyzation technologies.

- Rest of the World (RoW) includes Latin America, the Middle East, and Africa, where market growth is emerging but remains limited by lower R&D investment and infrastructure. However, increasing collaborations with global research institutions and gradual industrialization are expected to create new opportunities, particularly in Brazil and the Gulf states.

Overall, regional disparities in funding, regulatory environments, and industrial maturity will continue to shape the competitive landscape for nanoparticle analyzation technologies through 2025 and beyond.

Challenges and Opportunities in Nanoparticle Analyzation Technologies

Nanoparticle analyzation technologies are at the forefront of materials science, biotechnology, and pharmaceutical research, enabling precise characterization of particles at the nanoscale. As the demand for nanomaterials in drug delivery, electronics, and environmental monitoring grows, the need for advanced, reliable, and scalable analyzation tools intensifies. However, the sector faces a complex landscape of challenges and opportunities as it moves into 2025.

Challenges

- Technical Complexity: Accurate measurement of nanoparticles—often below 100 nm—requires highly sensitive instrumentation. Techniques such as dynamic light scattering (DLS), nanoparticle tracking analysis (NTA), and electron microscopy demand rigorous calibration and expertise, which can limit widespread adoption in non-specialist labs (Thermo Fisher Scientific).

- Sample Preparation and Contamination: Nanoparticles are prone to aggregation and contamination, complicating sample preparation and leading to inconsistent results. This is particularly problematic in biological and environmental samples, where matrix effects can obscure true particle characteristics (Malvern Panalytical).

- Standardization and Regulatory Hurdles: The lack of universally accepted standards for nanoparticle characterization impedes data comparability and regulatory approval, especially in pharmaceuticals and food safety (International Organization for Standardization (ISO)).

- Cost and Accessibility: High-end analyzation instruments remain expensive, restricting access for smaller research institutions and companies, particularly in emerging markets (MarketsandMarkets).

Opportunities

- Technological Innovation: Advances in machine learning and automation are streamlining data analysis and reducing operator dependency, making nanoparticle characterization more accessible and reproducible (Bruker Corporation).

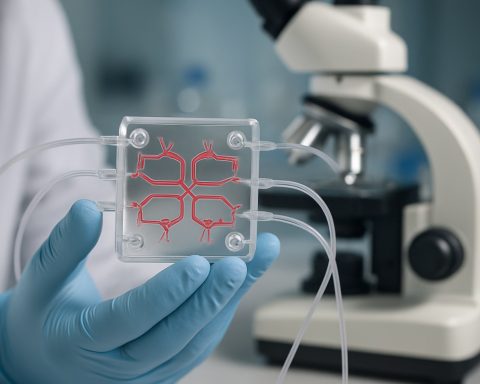

- Integration with Lab-on-a-Chip Systems: Miniaturized, integrated platforms are emerging, enabling real-time, in situ nanoparticle analysis for applications in diagnostics and environmental monitoring (Analytik Jena).

- Expanding Application Areas: The rise of nanomedicine, advanced coatings, and next-generation batteries is driving demand for precise nanoparticle analyzation, opening new market segments and fostering cross-industry collaborations (Grand View Research).

- Global Standardization Efforts: Ongoing initiatives by international bodies are expected to yield harmonized protocols, facilitating regulatory compliance and accelerating commercialization (Organisation for Economic Co-operation and Development (OECD)).

In summary, while nanoparticle analyzation technologies face significant technical and regulatory challenges, ongoing innovation and expanding applications are poised to drive robust growth and broader adoption through 2025 and beyond.

Future Outlook: Innovation, Regulation, and Market Expansion

The future outlook for nanoparticle analyzation technologies in 2025 is shaped by a dynamic interplay of innovation, evolving regulatory frameworks, and expanding market applications. As industries such as pharmaceuticals, electronics, and environmental monitoring increasingly rely on precise nanoparticle characterization, the demand for advanced analyzation tools is expected to accelerate.

Innovation remains at the forefront, with manufacturers investing in next-generation instruments that offer higher sensitivity, faster throughput, and multi-modal analysis capabilities. Technologies such as nanoparticle tracking analysis (NTA), dynamic light scattering (DLS), and electron microscopy are being enhanced with artificial intelligence and machine learning algorithms to automate data interpretation and improve reproducibility. Companies like Malvern Panalytical and Brookhaven Instruments are leading the charge by integrating cloud connectivity and real-time analytics into their platforms, enabling remote monitoring and collaborative research.

Regulation is also evolving, particularly as nanoparticles are increasingly used in consumer products and medical applications. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Commission are updating guidelines to ensure the safety and efficacy of nanomaterials, which in turn drives demand for more robust and standardized analyzation technologies. The push for harmonized international standards, as advocated by organizations like the International Organization for Standardization (ISO), is expected to foster greater transparency and comparability of nanoparticle data across borders.

- Market Expansion: The global market for nanoparticle analyzation technologies is projected to grow at a CAGR of over 6% through 2025, driven by increased R&D spending and the proliferation of nanotechnology-enabled products (MarketsandMarkets).

- Emerging Applications: New frontiers in drug delivery, energy storage, and environmental remediation are creating fresh opportunities for analyzation technologies, particularly those capable of characterizing complex, multi-component systems.

- Collaborative Ecosystems: Partnerships between instrument manufacturers, academic institutions, and regulatory agencies are accelerating the development of standardized protocols and reference materials, further supporting market growth.

In summary, 2025 will see nanoparticle analyzation technologies advancing rapidly, underpinned by technological innovation, tighter regulatory oversight, and broadening market adoption across diverse sectors.

Sources & References

- MarketsandMarkets

- Grand View Research

- Thermo Fisher Scientific

- Malvern Panalytical

- Bruker Corporation

- IBM

- HORIBA

- Beckman Coulter

- Brookhaven Instruments

- Particle Metrix

- European Medicines Agency

- National Institutes of Health

- National Science Foundation

- European Commission

- Ministry of Science and Technology

- International Organization for Standardization (ISO)

- Analytik Jena