- Global economic instability looms with the threat of recession and stagflation impacting markets worldwide.

- Ongoing U.S. tariffs and export curbs to China create volatility, particularly affecting the semiconductor industry with companies like Nvidia forecasting significant financial impacts.

- Federal Reserve Chair Jerome Powell signals caution about balancing inflation and economic growth, amplifying investor anxiety.

- The value of gold rises as nations stockpile amid geopolitical tensions and economic uncertainties.

- Corporate earnings from firms such as American Express, Netflix, and Schwab are under scrutiny as indicators of economic health.

- Ford warns of potential price increases due to tariff challenges, affecting both consumers and the auto industry.

- Taiwan Semiconductor faces uncertainties despite strong earnings, with global trade policies storming the semiconductor sector.

The global economic landscape resembles a turbulent sea, waves of uncertainty crashing over markets as the specter of recession looms ever closer. Despite a temporary respite granted by a 90-day postponement on new U.S. tariffs, markets remain jittery, with the specter of stagflation creating ripples of anxiety across the globe.

Asian markets, once buoyed by a short-lived rally, have slipped back into volatility, mirroring the skepticism that shadows investors’ minds. This uncertain terrain has left U.S. stock futures vacillating, dragged down by concerns of how new U.S. curbs on chip exports to China might herald rough waters ahead. Nvidia, a titan in the chip industry, finds itself at the heart of this storm, forecasting a staggering $5.5 billion charge—an alarming signal that echoes across the tech sector.

Meanwhile, the voice of Federal Reserve Chair Jerome Powell reverberates with caution. As he remarks on the delicate balance between inflation and a weakening economy, investors’ nerves crackle with concern. The dual mandate of optimizing employment and stabilizing prices, usually a tightrope walk, now appears a perilous dance on a high wire. As the economy strains under tariff pressures, the possibility of stagflation—a hazardous cocktail of rising inflation coupled with stagnant growth—emerges as a plausible threat.

As if seeking refuge amidst the turmoil, gold glistens more brightly than ever. This timeless haven, trusted in times of strife, sees its value soar to unprecedented heights. Countries fraught with geopolitical tensions, wary of shifting allegiances and economic reprisals, continue to stockpile this precious metal, safeguarding against an uncertain future.

Stateside, market players eye an array of corporate giants set to disclose their financial health. American Express, Netflix, and Schwab stand ready to unveil quarterly earnings, their reports keenly anticipated as potential harbingers of economic trajectory. In the auto realm, Ford hints at impending price hikes should tariff alleviation fail to materialize, casting a shadow over consumers and the industry alike as summer approaches.

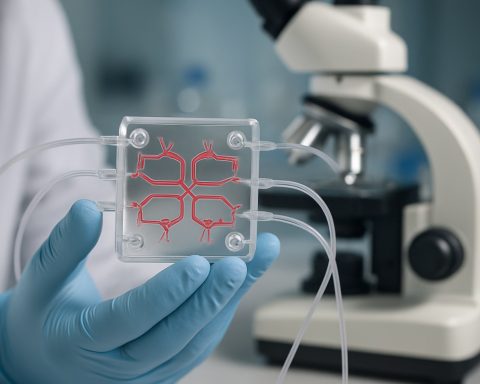

Amidst these global machinations, Taiwan Semiconductor (TSMC) emerges as a focal point. Despite surpassing first-quarter earnings expectations, looming tariffs and stringent export controls on clients like Nvidia and AMD create a fog over its forecast. The semiconductor industry, a linchpin of modern technology, braces for potential disruptions as international trade policies shift unpredictably.

The story unfolding is as multifaceted as it is uncertain, a narrative of global economies swaying to the cadence of tariffs and trade. The central takeaway anchors in the apparent fragility of markets—reflecting the precarious dance between policy, global trade relations, and economic stability. As the world watches and waits, every investor, policymaker, and citizen is reminded of the intricate dance of global economics in an ever-connected world.

Surviving the Economic Storm: What You Need to Know About the Global Market Unrest

Current Global Economic Landscape

The global economy today is akin to a turbulent sea, with markets roiled by unrest and uncertainty. Central to this is the looming threat of a recession, intensified by ongoing geopolitical tensions and fluctuating trade policies. Despite a temporary cessation in new U.S. tariffs, market volatility persists, especially in the tech sector, where new U.S. chip export restrictions to China are causing significant unease.

Stagflation Concerns and Federal Reserve’s Stance

Stagflation, the perilous blend of stagnant growth and rising inflation, is an increasingly plausible risk. Federal Reserve Chair Jerome Powell has consistently emphasized the dual challenges of cooling inflation without stalling economic growth. Navigating this delicate balance is crucial to prevent the compounding economic difficulties that stagflation could bring.

Gold: The Safe Haven Asset

Amid economic turmoil, gold has once again emerged as a reliable hedge against uncertainty. With countries escalating their gold reserves due to geopolitical instability and economic sanctions, the precious metal’s value has soared to unprecedented heights, serving as a safeguard in these volatile times.

Impact on the Tech Sector

Nvidia, at the forefront of the chip industry, faces a significant $5.5 billion charge due to export restrictions to China, highlighting the sector’s vulnerability to shifting trade policies. Taiwan Semiconductor Manufacturing Company (TSMC), despite strong earnings, remains cautious as potential disruptions loom from U.S. export controls affecting its major clients, including Nvidia and AMD.

Corporate Earnings and Economic Indicators

Key corporate earnings reports from giants like American Express, Netflix, and Schwab are closely watched as indicators of economic health. In the automotive industry, Ford’s potential price hikes due to tariffs signal more turbulence ahead, affecting both consumers and the market landscape.

Strategies to Navigate Uncertainty

For investors and businesses, navigating this economic landscape requires a strategic approach:

1. Diversify Investments: Spread investments across various asset classes to mitigate risk.

2. Monitor Market Trends: Stay informed about global market developments and policy changes.

3. Consider Safe Havens: Allocate a portion of your portfolio to safe-haven assets like gold.

4. Agile Supply Chains: Businesses should build flexible supply chains to adapt to quick policy shifts.

5. Cost Management: Companies should focus on cost control to safeguard margins amidst pricing pressures.

Industry Trends and Forecasts

1. Semiconductor Dominance: The semiconductor industry will remain central to technology growth, despite trade hurdles.

2. Shift Towards Resilience: Expect a corporate push towards creating more resilient supply chains and localized production.

3. Increased Gold Demand: The demand for gold is likely to continue rising as geopolitical uncertainties persist.

Conclusion: Preparing for Economic Resilience

As markets worldwide grapple with volatility, it is crucial for stakeholders at all levels—from investors to policymakers—to prepare for an uncertain economic future. By understanding market dynamics and adopting proactive strategies, one can better navigate the ups and downs of these turbulent times.

For further insights into global economic strategies, visit the official websites of reputable sources such as the International Monetary Fund and the Federal Reserve.